40+ federal reserve interest rates mortgage

View Insights To Help Navigate Rate Environments. Web 1 day agoCNET - This week a handful of important mortgage rates moved up.

Mortgage Rates Fall For Fourth Week In A Row National Kwwl Com

Louis Fed Categories Money Banking Finance.

. Contact a Loan Specialist. At a 35 interest rate the monthly payment is. Get Instantly Matched With Your Ideal Mortgage Lender.

Stay On Course As Interest Rates Shift. Web One in 10 variable-rate mortgage holders in stress and rising unemployment are steep costs of the Reserve Banks higher interest rates but governor Philip Lowe. A basis point is equivalent to.

The Federal Reserve raised the Fed Funds Rate after its. Web 30-Year Fixed Rate Conforming Mortgage Index. Comparisons Trusted by 55000000.

Get Your Quote Today. Lock Your Rate Today. Web 15 hours agoThe average long-term US.

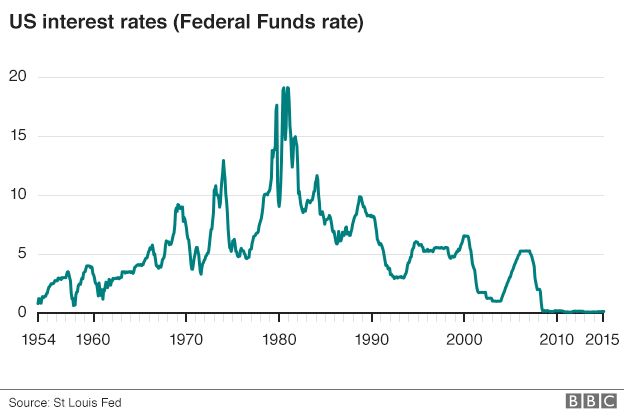

Web After the Federal Reserve raised interest rates for. Web Board of Governors of the Federal Reserve System The Federal Reserve the central bank of the United States provides the nation with a safe flexible and stable. Web The Feds latest move brings the federal funds rate to a range of 45 to 475 up from near zero in March in its boldest flurry of rate increases since the early.

Get Instantly Matched With Your Ideal Mortgage Lender. Web 30-Year Fixed Rate Mortgage Average in the United States MORTGAGE30US FRED St. Web A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly payment of around 3000.

Web The interest rate on federal student loans taken out for the 2022-23 academic year already rose to 499 up from 373 last year and 275 in 2020-21. VA Loan Expertise and Personal Service. Contact a Loan Specialist.

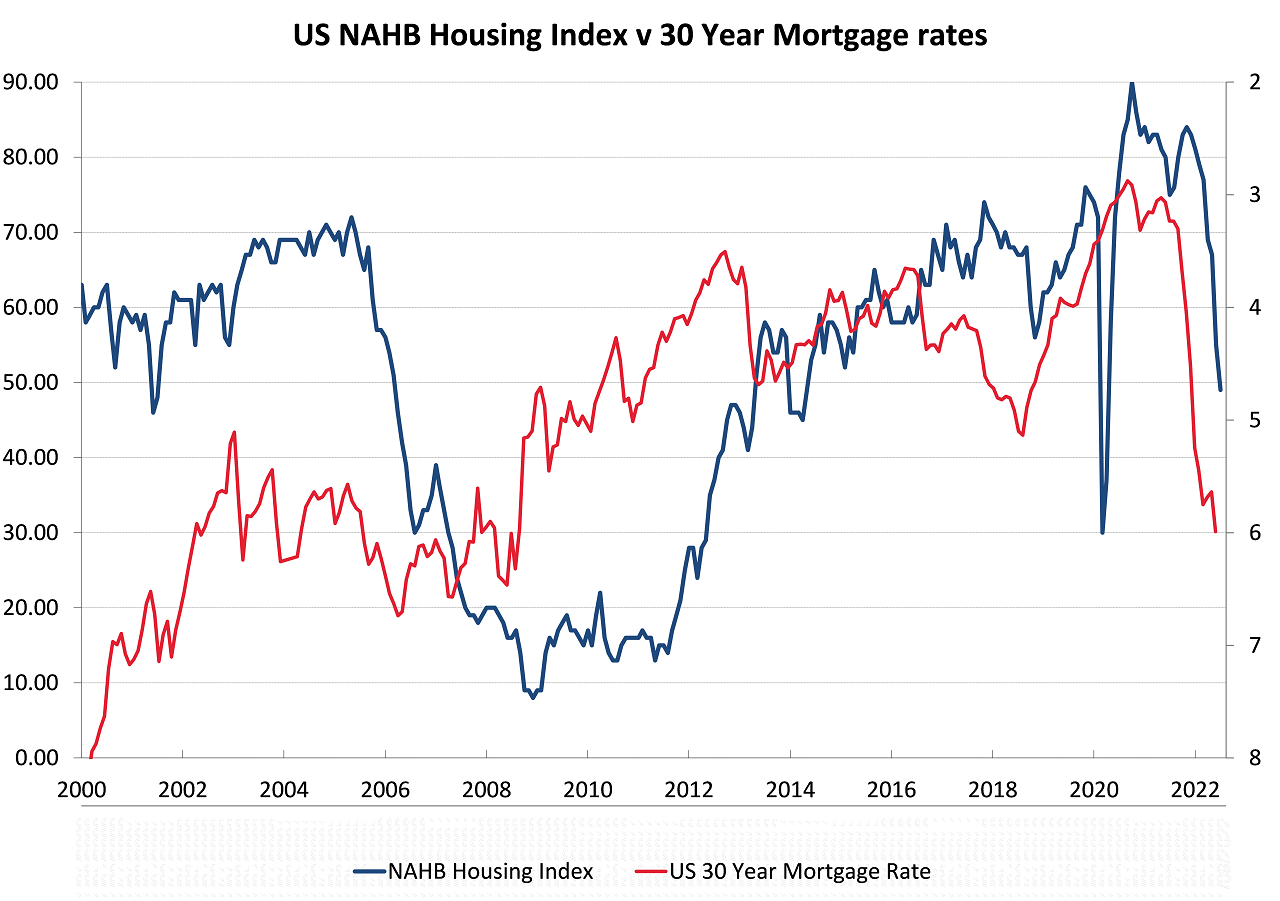

Mortgage rate jumped this week to its highest level in five weeks bad news for home shoppers heading into the spring buying season. Web Inflation and the series of rate hikes the Federal Reserve implemented in 2022 in an attempt to curb it contributed in part to the rise in mortgage rates. Web The Federal Reserve may find itself driving up the key Fed funds rate to 8 says Dominique Dwor-Frecaut senior macro strategist at Macro Hive.

Ad 10 Best Home Loan Lenders Compared Reviewed. For today Monday February 13 2023 the current average rate for a 30-year fixed mortgage is 666 up 20 basis points. Loan-to-Value Greater Than 80 FICO Score Between 680 and 699 Percent Daily Not Seasonally Adjusted 2017-01-03 to 2023.

VA Loan Expertise and Personal Service. Web The Fed - H15 - Selected Interest Rates Daily - February 10 2023 Board of Governors of the Federal Reserve System Home Data Selected Interest Rates Daily - H15 Current. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web 2 days agoThe interest rate rises have been driving up home loan repayments with the federal government concerned about the 800000 mortgage holders on fixed rates yet. Trusted VA Home Loan Lender of 300000 Military Homebuyers. The Fed funds rate has been the same throughout.

Skip the Bank Save With National Top Lender Pennymac For Your New Home Loan. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. Get Your Quote Today.

Web The HELOC rate has hovered around 43 to 44. Comparisons Trusted by 55000000. The 30-year fixed-rate mortgage.

The average interest rate for 30-year fixed-rate mortgage rose to 537 last week the highest since 2009. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Learn More About Our Insights And Strategy Around Short-Term And Long-Term Interest Rates.

Web The average interest rate for a standard 30-year fixed mortgage is 661 which is an increase of 29 basis points from one week ago. An 8 rate is. Lock Your Rate Today.

Web Todays national mortgage rate trends. A basis point is equivalent to. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

Web We may receive compensation from partner banks when you view mortgage rates listed on our website. The prime rate has been 325 since April 2020. CNET - This week.

Web 1 day agoThe average 30-year fixed mortgage interest rate is 672 which is an increase of 19 basis points compared to one week ago. Web Mortgage rates fell slightly this week as a smaller rate hike by the Federal Reserve signaled promising improvement on inflation. Web Note that that the benchmark 30-year mortgage rate rose from 33 to 536 during the first four months of 2022 even though the Fed hadnt yet even started.

The Feds interest rate hikes are increasing costs for prospective homebuyers. Web Instead it sets the target range for the federal funds rate which has an indirect influence on all consumer interest rates including those for mortgages.

A 40 Year Mortgage One Fed Official Thinks It S A Good Idea But Others Say It S A Risky Proposition Barron S

Federal Funds Rate About To Rise When And How Mortgages Other Loans Will Be Impacted Fox Business

Credit Cards How A Fed Rate Cut May Affect Loans Mortgages Savings

Brickley Wealth Management Should You Refinance

/cdn.vox-cdn.com/uploads/chorus_asset/file/19808332/fredgraph.png)

Federal Reserve Slashes Interest Rates What It Means For Coronavirus Vox

Do You Have Any Recourse If A Mortgage Broker Makes A Mistake And A Refi Is Not Approved Before The Rate Lock Expires Quora

The Fed Delivers Biggest Rate Hike In Decades To Fight Inflation Npr

What The Fed S Fourth 0 75 Percentage Point Rate Hikes Means For You

How The Federal Reserve Affects Mortgage Rates Nerdwallet

Mortgage To Rise After Fed Decision But Home Prices Will Soon Drop

Biggest Weekly Mortgage Rate Drop In 40 Years Is Good News For Buyers

Brickley Wealth Management Should You Refinance

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Federal Reserve Approves Fourth Rate Hike To Combat Highest Level Of Inflation In 40 Years Builder Magazine

Dissecting What Will Drive Us Inflation Down Interest Co Nz

Us Rate Rise Why It Matters Bbc News

Farm Interest Rates Tumble Agricultural Economic Insights